Unveiling the Benefits of Offshore Company Development and Its Operational Structure

The appeal of tax obligation advantages, asset defense, and boosted privacy steps connected with offshore firm formation is obvious. By unraveling the complexities of offshore company development and its functional needs, a clearer understanding of the advantages and obstacles that come with this organization framework arises.

Tax Benefits of Offshore Firms

The tax advantages connected with overseas firms can supply substantial advantages for businesses looking for to maximize their monetary methods. Offshore firms are usually developed in jurisdictions that use positive tax conditions, such as low or absolutely no business tax obligation prices, tax exemptions on particular types of earnings, and reduced tax obligation reporting demands. By leveraging these advantages, businesses can reduce their general tax obligation worry and increase their profitability.

One trick advantage of offshore firms is the capability to legally decrease tax obligations through techniques like revenue moving, where earnings are alloted to entities in low-tax jurisdictions. This can cause substantial cost savings contrasted to operating only in high-tax areas. In addition, overseas business can gain from tax obligation deferral, allowing them to reinvest revenues and defer tax obligation settlements to a later day.

In addition, some offshore jurisdictions supply discretion and privacy securities, making it possible for companies to conduct their affairs inconspicuously. Offshore Company Formation. This can be especially helpful for companies running in sensitive sectors or seeking to secure their properties from potential legal risks. Generally, the tax benefits of overseas business existing valuable possibilities for companies seeking to improve their monetary performance and competitiveness

Property Protection Techniques

Efficiently taking care of tax obligation benefits via overseas company development can lay a strong structure for executing durable possession defense techniques. Offshore business supply different lawful devices and structures that can improve possession protection. It's vital to work very closely with financial and legal experts to make certain conformity with pertinent regulations and guidelines while creating and implementing effective property protection techniques through overseas firm developments.

Improved Privacy Procedures

Enhancing confidentiality safeguards within offshore business structures is critical for people and businesses seeking enhanced personal privacy measures in their asset management techniques. Offshore jurisdictions typically provide stringent privacy legislations and policies that shield the identifications of business proprietors from public disclosure. By establishing a firm in a territory with durable personal privacy procedures, people can boost their privacy and protect delicate financial info from prying eyes.

Furthermore, making use of nominee directors and shareholders in overseas firm structures can further enhance privacy by giving an extra level of splitting up in between the company's operations and its advantageous proprietors. These nominees work as figureheads, properly shielding the real proprietors' identities and including an additional veil of personal privacy to the firm's possession framework.

Operational Demands for Offshore Business

Ensuring compliance with the functional requirements stated in overseas territories is necessary for the successful facility and upkeep of overseas firms. These requirements commonly include preserving correct economic records, holding yearly general meetings, and making certain that company tasks line up with the laws of the territory. Offshore business are commonly needed to select regional directors or have a registered office within the jurisdiction.

Additionally, sticking to tax obligation policies is critical for offshore companies to preserve their status. This includes meeting tax responsibilities both in the offshore territory and potentially in the home nation of the company's helpful proprietors. Fulfilling reporting requirements, such as sending yearly returns and economic statements, is also vital.

In addition, overseas business have to adhere to anti-money laundering (AML) and understand your customer (KYC) regulations to avoid illicit tasks. These policies might entail conducting due diligence on clients and maintaining records of purchases. Offshore Company Formation. By satisfying these functional needs, offshore business can run effectively and preserve their trustworthiness within the global service landscape

Lawful Frameworks Governing Offshore Workflow

To develop a durable structure for overseas business, comprehending the legal frameworks governing offshore procedures is paramount in browsing the intricacies of worldwide company regulations and conformity needs. One crucial element of offshore lawful structures is the requirement to conform with both the laws of the home country where the firm is registered and the jurisdiction where it operates.

Moreover, overseas business must additionally take into consideration worldwide legislations, treaties, and agreements that influence their procedures. For example, anti-money laundering regulations, information security laws, and worldwide trade arrangements can significantly affect imp source how overseas firms conduct their business tasks. Comprehending and sticking to these legal structures are vital for offshore companies to operate ethically, transparently, and within the boundaries of the law.

Final Thought

In final thought, overseas company formation provides countless advantages such as tax obligation benefits, possession defense, and enhanced privacy actions. By establishing an overseas firm, organizations and individuals can maximize their financial methods and protect their possessions successfully.

Offshore firms are frequently established in territories that supply favorable tax obligation problems, such as low or no corporate tax prices, tax obligation exceptions on specific types of income, and lowered tax obligation coverage requirements. Additionally, overseas firms can benefit from tax deferment, enabling them to defer and reinvest earnings tax obligation repayments to a later date.

Ensuring conformity with the functional requirements established forth in overseas jurisdictions is important for the successful facility and maintenance of overseas companies.To establish a durable foundation for offshore companies, comprehending the lawful frameworks controling see overseas procedures is critical in navigating the intricacies of international organization guidelines and conformity demands.In conclusion, offshore company formation YOURURL.com provides various advantages such as tax advantages, property protection, and boosted privacy actions.

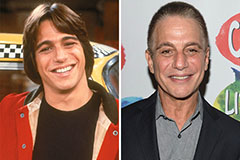

Tony Danza Then & Now!

Tony Danza Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now!